Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

For years, the push toward a cashless society has been sold as a matter of convenience. Tap your phone, scan a code, and walk away—it all seems harmless, right? But what if cashless isn’t about making life easier? What if it’s about total control?

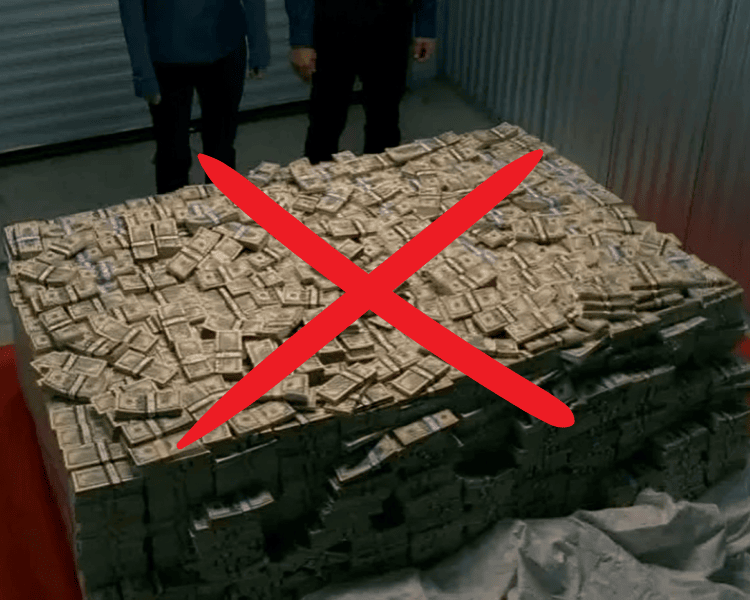

Governments and banks want you dependent on digital transactions—not because they care about efficiency, but because it allows them to monitor, restrict, and ultimately control every aspect of your life. The moment physical cash is gone, they own you.

But don’t just take my word for it. Let’s look at how this financial prison is already being built around us and—more importantly—how we can fight back.

A fully digital financial system means every single transaction you make can be tracked, analyzed, and even blocked. Think that sounds paranoid? Just look at China’s social credit system. People who speak out against the government find themselves barred from buying plane tickets, renting apartments, or even using public transport.

Once cash is eliminated, you won’t have an alternative when they turn off your access. If you say something “wrong,” suddenly your bank account is frozen. No groceries, no gas, no ability to live.

And it’s already happening.

In 2025, Barclays Bank customers in the UK found themselves completely locked out of their money when the banking system suffered a massive outage. People couldn’t access their accounts, make payments, or withdraw their own cash.

Barclays’ response? They advised customers to use food banks. Let that sink in—rather than ensuring people had access to their funds, the bank essentially told them to beg for food.

This is exactly what a cashless society looks like. If banks or governments decide you can’t access your money—you’re done. No cash means no backup plan.

One of the biggest dangers of digital currency is programmability. Unlike cash, which you can spend however you like, digital currency can be controlled at the source.

If you think this is far-fetched, look no further than fridges in China that scan your social credit score before letting you make a purchase. If your score is too low—the fridge locks you out.

In 2022, Canada provided a chilling example of how digital finance can be weaponized. When truckers protested against government mandates, their bank accounts were frozen overnight.

What happens when there’s no more cash to fall back on? The ability to shut down dissenting voices will be instant.

So what can we do? The good news is we’re not powerless. Here are some simple but powerful steps to resist the cashless takeover:

Every time you use cash, you’re keeping physical currency in circulation and making it harder for them to justify eliminating it. Small businesses love cash—it helps them avoid banking fees and government tracking.

Some companies are already refusing cash—boycott them. Support businesses that still allow physical money and encourage others to do the same.

When the next banking outage happens, you don’t want to be like Barclays customers begging for food. Keep a stash of physical cash in case you need it.

Most people still don’t see the dangers of a cashless society. Share articles, have discussions, and wake people up before it’s too late.

Relying solely on banks is a mistake. Look into alternative stores of value like gold, silver, Bitcoin, and barter networks.

A cashless society isn’t about convenience—it’s about control. The ability to shut off dissenters, program what people can buy, and force compliance through financial coercion is already being tested around the world.

If we don’t resist now, we’ll wake up one day to find cash gone, privacy erased, and financial freedom a relic of the past.

📖 Read More: The Silent Chains: How Tyranny Flourishes in Plain Sight

💬 How have you been using cash in your daily life? Have you noticed businesses pushing towards digital-only payments? Share your thoughts in the comments below!